Remember When Everyone Thought the Rally Was Over?

Let’s rewind to early April. The stock market looked like it had hit the brakes. Headlines screamed about “market fatigue” and “valuation risks.” The BSE’s total market capitalisation had slipped to $4.5 trillion, and the mood? Let’s just say it wasn’t exactly festive.

But here we are—just weeks later—and bam! India’s equity market is back in the $5 trillion club, rubbing shoulders with heavyweights like the US, China, Japan, and Hong Kong.

Talk about a comeback, right?

So… What Sparked This Sudden Surge?

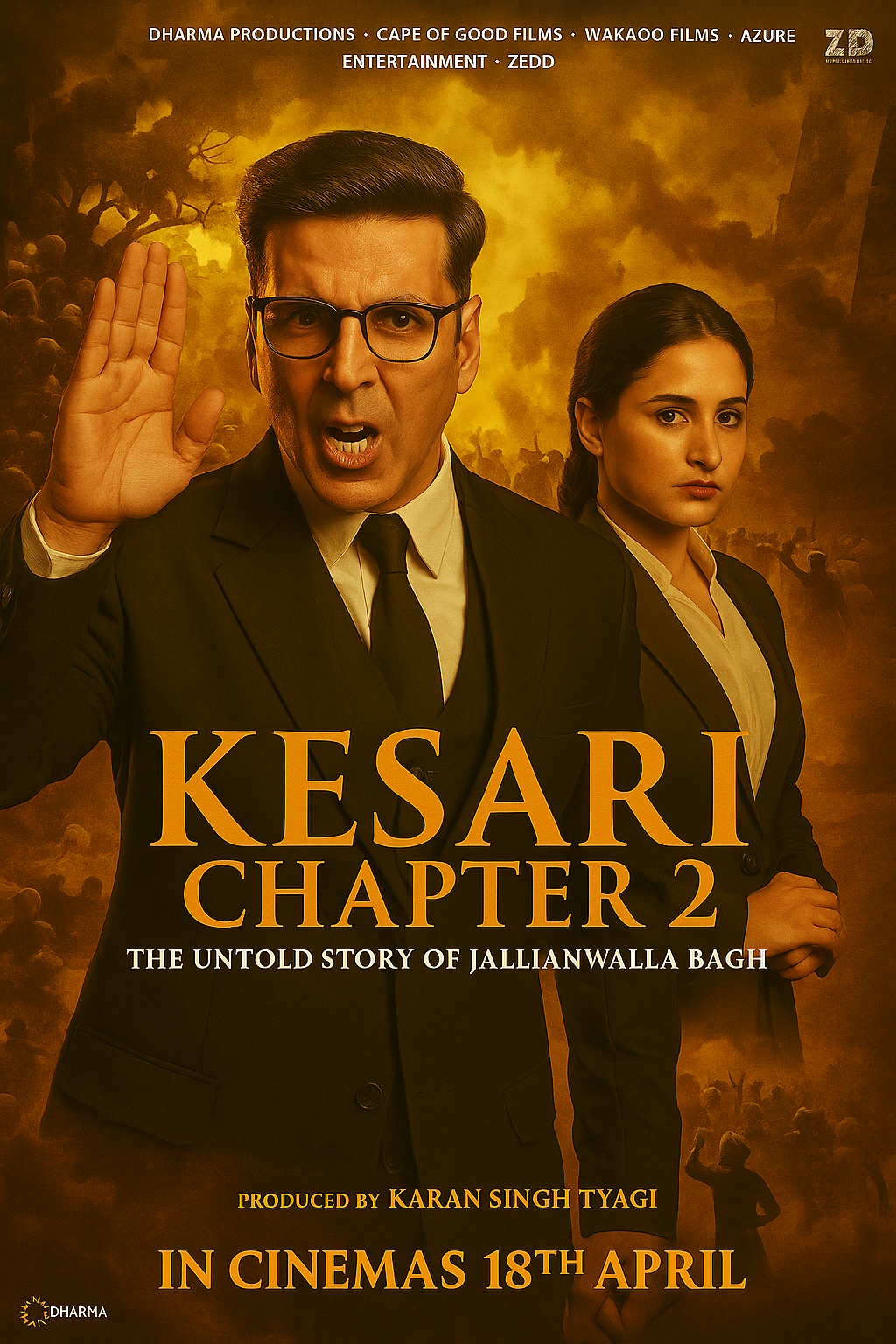

Honestly, this feels like one of those Bollywood plots where the hero takes a beating but rises stronger in the second half. Except in this case, the hero is the Indian stock market, and the script? Well, it’s a mix of economic triggers, investor psychology, and a dash of geopolitical drama.

Let’s break it down.

The Power Moves Behind the Market Rally

1. The US Hit Pause on Tariffs

Yep, this one was a game-changer.

When the US decided to hold off on reciprocal tariffs on April 7, global markets sighed in relief. It triggered a shift from “risk-off” to “risk-on,” and investors rushed back to equities like it was Black Friday.

India, being one of the more resilient emerging markets, benefited big time.

2. JD Vance Comes Calling

US Vice President JD Vance is currently in India, meeting PM Modi and likely discussing—you guessed it—trade.

His visit is being read as a diplomatic olive branch, and the markets are loving it. If this results in more bilateral cooperation, it’s going to be a long-term win for Indian equities.

3. Crude Oil Prices Are Cooling Off

Remember those sky-high fuel prices that made us flinch every time we passed a petrol pump?

Well, crude oil has cooled, and that's a big deal. It eases inflation, improves the trade deficit, and lifts corporate margins across sectors—from logistics to FMCG.

Basically, less oil drama = more market optimism.

4. PSUs Are Back in Fashion (Yes, Really!)

Raise your hand if you ever wrote off PSUs as “boring old-school stocks.” Been there, done that.

But lately? BSE PSU Index is up 10% since April 7. That’s not a fluke—it’s a signal. With government reforms, better balance sheets, and renewed investor interest, public sector undertakings are suddenly the cool kids on Dalal Street.

5. Smallcaps and Midcaps Join the Party

It’s not just the Sensex and Nifty doing the heavy lifting. Even the BSE Midcap and Smallcap indices are up 9.4% and 10.6%, respectively.

That’s huge—because it shows breadth in the rally, not just depth. Everyone’s getting a slice of the pie.

The Numbers That Matter

Let’s look at the scoreboard since April 7:

- Sensex & Nifty: Up ~9% each

- BSE Midcap Index: Up 9.4%

- BSE Smallcap Index: Up 10.6%

- Nifty Bank: Up 11%

- Foreign inflows: Over $1 billion net in just two sessions (NSDL)

Honestly, if this doesn’t scream “comeback,” I don’t know what does.

What Are the Experts Saying?

“The current market surge reflects a potent combination of strong domestic fundamentals, favourable global factors, and consistent investor confidence.” — Vinit Bolinjkar, Head of Research at Ventura

Meanwhile, IIFL Securities believes there’s still more steam left in the engine. They’re projecting another 5–10% upside, especially for smallcaps, which they say are now attractively valued after months of downgrades.

But here's the catch—macro indicators still hint at a cyclical slowdown, so it’s not all sunshine and rainbows.

So, Should You Jump In or Stay Cautious?

Here’s the thing: The market looks healthy, yes. But it’s also like riding a wave—you need balance, timing, and a solid grip on the board.

Experts suggest:

- Focus on domestic-driven themes over global ones

- Financials, PSUs, metal, telecom, pharma, and consumption are looking strong

- IT, capital goods, and infra could offer good risk-reward setups

- Stay alert to global headlines (because one bad geopolitical twist can flip the script)

What’s It Like for Retail Investors?

Let me tell you from personal experience—this market feels alive again.

I’ve got friends texting me screenshots of their portfolios (with more emojis than data), my retired uncle finally logging into his demat account again, and that one cousin who “knew Adani would bounce back” suddenly turning financial guru.

It’s that kind of vibe right now.

But I always say—don’t chase the rally, ride it smart. SIPs, diversification, and keeping emotions in check? That’s how you win the long game.

Quick FAQs

Q1. Is this a good time to invest in Indian markets?

If you’re in it for the long haul, yes. But avoid lump sum FOMO moves—stick to disciplined investing.

Q2. Why did Indian markets cross $5 trillion again?

Thanks to a mix of global cues, policy optimism, improved corporate earnings estimates, and foreign investor inflows.

Q3. Which sectors are expected to perform well?

Financials, PSUs, metals, pharma, telecom, and domestic consumption are currently looking solid.

Q4. What risks should investors be aware of?

Global uncertainties, commodity price swings, and India’s own cyclical slowdown signals.